With a central market dynamic of value gains set against volume decline, manufacturers look to population trends and changes in hygiene routines for expected growth. Euromonitor International’s Liying Qian, Industry Manager for Tissue & Hygiene, looks at Africa’s top performing tissue markets.

The African continent is faced with a consumer reality where the focus is firmly on affordability and value, driven by its complex socio-economic reality combining a large and expanding population and yet an average household disposable income significantly lower than the global average. Such diverging complexity reveals the region’s key tissue market characteristics characterised by under-penetration and price sensitivity, which has squeezed brand loyalty and created fierce competition from local players. Let’s start with the numbers. In 2023, most African tissue markets saw elevated or even accelerated nominal value sales growth (in USD million, including inflation effect) led by inflation and at the expense of volume growth. Such widening gaps between value and volume sales growth is especially notable in Egypt’s and Nigeria’s retail tissue, where volume sales plunged into a further decline in 2023 compared to 2022, while retail value sales growth significantly accelerated.

At the opposite side is South African, which boasts the highest per capita tissue volume consumption and disposable incomes in the region despite massive income inequality, and which proved quite resilient. Volume growth in retail and AfH tissue consumption in 2023 marginally improved from a year ago, while nominal value growth slightly softened albeit staying elevated.

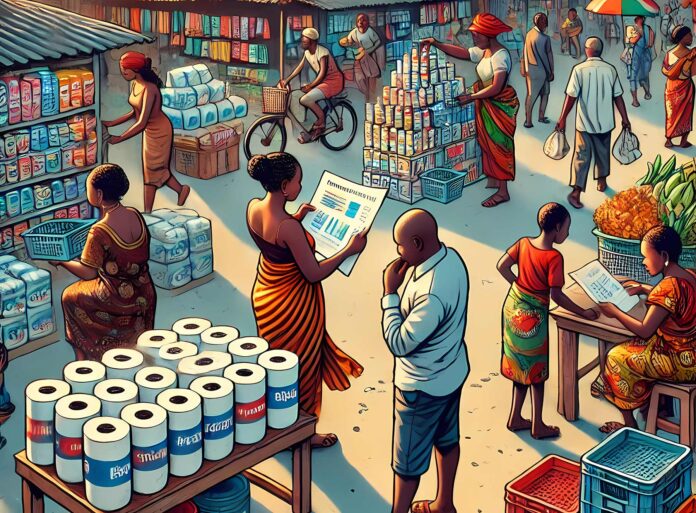

As affordability remains top of mind, purchase rationalisation, sharpened focus on value for money, and a shift towards bulk purchases continues to shape tissue production priorities such as localisation, SKU rationalisation, efficiency-led new product launches and promotion strategies.

To illustrate industry dynamics, from consumption growth patterns to innovation trends and competitive dynamics, this article will focus on the top African tissue markets: South Africa, Egypt, and Morocco.

South Africa

Inflation pressure and shrinkage of recycled paper (a key source of retail tissue product in South Africa) have boosted unit price and reinforced consumer rationalisation. Nonetheless, volume consumption in retail and AfH experienced steady growth.

As such, tissue manufacturers focused more production resources on most in-demand tissue types – toilet paper and paper towels, with the former driving the vast majority of increment volume sales increase in retail and AfH tissue 2022-2023. While consumers continued to acknowledge the versatile cleaning essentiality of paper towels at home, they have turned a keen eye towards value for money in terms of size and absorbency, increasingly echoed in manufacturers’ product developments.

For instance, Dinu, a leading paper towel brand in South Africa produced by Universal Paper & Plastics, traditionally offered paper towel with 50 sheets sold in packs of two under Everyday Collection, and has now started to offer four rolls of paper towels in one pack and include 100 sheets in Mega Roll to allow for bulkier economical buys.

In addition to larger size offering, virgin pulp formulation, which aligns with consumer demand for high absorption and durability, is likely to gain popularity due to higher quality. In fact, virgin pulp offerings are increasingly explored by leading brands such as Dinu, as well as manufacturer Twinsaver.

While name brands continued to compete through value creation among higher-income consumers, private label maintains its pricing advantage most notably in napkins. Promotional strategies such as rewards programmes offered by key retailers like Dis-Chem Pharmacy also help stimulate private label’s attraction, as mirrored in the growing market share of two largest retail tissue channels – grocery retailers (mainly supermarkets) and health and beauty specialists (including pharmacies). Collectively, private label owned 42% of South Africa’s retail tissue value sales in 2023, up from 39% in 2019.

AfH tissue in South Africa also saw growth. In 2023, AfH tissue’s volume sales for the first time since 2020 surpassed the 2019 level. Despite inflation’s grip on macroeconomic and disposable income growth, positive tourism prospects and reinforcement of traditional office working hours are predicted to support further demand for AfH tissue forecast growth. According to Euromonitor’s research, per capita consumer expenditure on hotels and catering (USD, current prices, fixed 2023 ex rates) in South Africa in 2023 grew 17%, finally surpassing the 2019 level.

In AfH, as in retail tissue, toilet paper is the main driver of incremental volume growth 2022-2023. Lower-priced tissue options will likely see more gains in AfH over forecast period than other products. As such, manufacturers are diverting budgets towards less expensive product lines and cutting reliance on imports, as evidenced by Kimberly-Clark’s expansion of production capacity and asset upgrades.

However, this move also brings additional taxation costs as well as increased input costs due to higher fuel and electricity tariffs in South Africa, as observed at the end of the review period, making supply localisation an ongoing target.

Egypt

Among key African continent tissue markets, Egypt saw the largest declines in tissue volume sales in 2023. Retail tissue volume consumption decline exacerbated further to drop below 2019 level. AfH tissue volume sales in 2023, despite moderate growth, has slowed in growth from 2022’s 5% to just under 2%, below 2019’s level.

Of all retail tissue products, facial tissues – the largest product segment – drove almost the entirety of topline incremental volume decline 2022-2023. Boxed facial tissues particularly saw an increase in sales volume, accompanied by a double-digit rise in sales value due to a substantial increase in average unit price. Despite price sensitivity, many consumers perceive facial tissues as substitutes for general-purpose wipes and pocket tissues.

Paper towels is the only retail tissue segment seeing volume growth despite price challenges. Although many consumers attempted to cut cost by using reusable alternatives, increased home cooking occasions due to cutback on outdoor spending and increased demand for convenience have supported paper towels usage.

Supermarkets, the largest retail channel is the only retail channel gaining shares 2022-2023, thanks to its abundance of economical options and discounts.

Though a small, developing tissue market, Egypt is faced with a slew of challenges, particularly economic constrains, political instability as well as difficulty for the government to secure foreign currency for manufacturers to import needed materials for local production. All these, alongside lower consumer product education and access, can hinder local manufacturers from reaching full production potential and economies of scale.

Competitively, the Egyptian tissue market is heavily dominated by local players, with few multinationals making headways. Hayat is one, thanks to its long-time local investment, product diversification and targeting of high-demand tissue types and consumer preferences.

In AfH, while total volume sales in 2023 remained below 2019 level, nominal value sales almost doubled 2019, largely driven by the HoReCa channels which accounted for more than half of AfH tissue sales in 2023. The growing tourism sector is one of the major sources of foreign exchange for the Egyptian economy and fuelled by a double-digit increase in inbound tourists and the Egyptian government’s investment, as well as increased outdoor dining and activities were key contributors.

Morocco

In 2023, retail tissue categories recorded dynamic growth in Morocco, while AfH tissue had more lacklustre performance, with absolute volume consumptions still below 2019’s level.

On the retail side, 2023 incremental growth was further driven by the economic end of the market, with cheaper products becoming more widely available due to inflation. Toilet paper was a key driver of retail volume growth in 2023, as more consumers switched from using the traditional method of washing with water to using toilet paper and continued to consider toilet paper as a versatile cleaning agent across use occasions.

As middle-income consumers shift to thicker, higher-quality tissue goods such as 4-ply toilet paper, which accounts for less than 30% of total toilet paper sales, manufacturers also increasingly target the higher-priced end by launching 4-ply toilet paper and facial tissues with greater comfort and absorbency, as exemplified by Selpak Deluxe, Tempo Blanc, Tempo and Kleenex Balsam. Toilet paper with plant-based, botanical scents, as offered by brand Fancy, also made inroads.

Retail tissue in Morocco remained competitive and fragmented.

Novatis Group, the largest producer of retail tissue in Morocco, retained its value lead of the landscape in 2023 with its brands Dalaa, Sany, Pandoo and Ever Silk, thanks to its wide retail distribution, promotions, and widening product selections. However, similar to its regional peers, with a lack of brand loyalty in tissue, most price-sensitive Moroccans were favouring economical bulk formats, low prices and discounts, hence favouring cheaper domestic brands. Private labels such as Marjane, Blume, Janis and Carrefour maintained its foothold due to retailers’ footprint expansion in urban and suburban areas, diversification into all retail tissue categories, and packaging upgrades.

AfH tissue’s 2023 volume sales, despite improved growth from 2022’s 3% to just under 6% in 2023, has yet to fully recovered declines in 2020 and 2021 and remained below 2019 level. This is mirrored in the country’s still partial recovery in consumer foodservice and tourism, industries responsible for nearly 60% of total AfH tissue volume consumption in 2023.

In the near future, cost remains a challenge for growth in AfH tissue, particularly for paper towels and napkins. While demand for low-priced products will likely benefit local suppliers such as Novatis Group and Brior, this could change in the coming years as multinational companies seek to expand into the AfH channel – especially Turkish companies such as Hayat Morocco and ECP Maroc. Both multinationals’ brands have already been gaining popularity in retail through quality and variety.

Conclusions

Favourable population trends and changes in hygiene routines signify ample, albeit challenging-to-penetrate growth potential. Population growth and still low per capita tissue consumption are likely to bode well for long-term tissue growth on the African continent, owing to improved accessibility of sanitation infrastructure in households and increased consumer hygiene habits and product availability and awareness.

With per capita consumption of tissue in Egypt, Morocco and many other regional peers estimated at under 3kg, below global average and developed countries’ levels, countries in the region see a long growth journey.

However, macro challenges such as high inflation, a fair share of households in key markets with no flush toilets, a change of awareness and habit through improving product accessibility, variety and the local supply chain efficiency can help make the change.