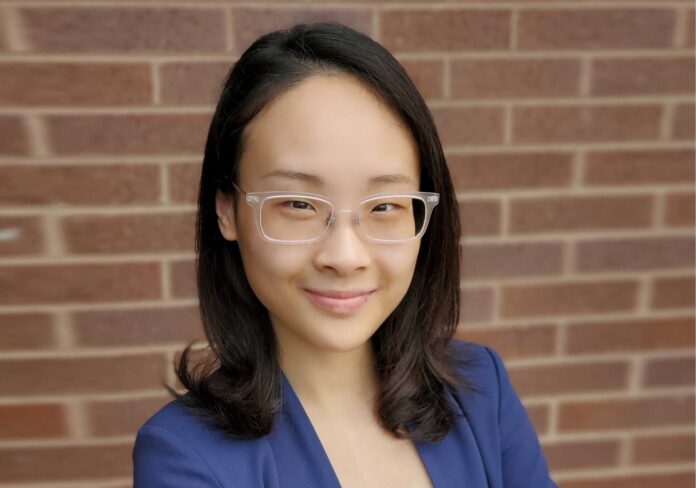

2023 was a year of demand recovery in consumer tissue. However, elevated inflation has led to diverging performance in value and volume sales across tissue categories, most notably in paper towels and paper tableware. Such divergence, underpinned by inflation-induced consumption rationing and trade-outs, reflects a new consumer reality where the focus is firmly on affordability, value, and cost of living.

While key fundamentals such as real disposable income recovery and population growth will sustain the resilience of consumer tissue demand, this value-centric economic reality will likely sustain a lifestyle pursuit towards simplicity, which will shape tissue’s preference and businesses’ value creation.

Euromonitor International has summarised four manifestations of simplicity shift in consumer tissues – back to basics, blurring wellness, digital rewire and affordable sustainability.

Back to basics

Consumers are accelerating recessionary behaviours to cope with the rising cost of living, demonstrating a growing desire for back to basics.

Back to basics in tissue is often reflected in trading down to cheaper options, as evidenced in private label’s consistent growth in sales and market share at the expense of top players 2018-2023. Yet, it is also evidenced in a sharpened focus on products’ fundamental benefits such as cleaning efficiency, as demonstrated in the latest product releases such as Procter & Gamble’s Bounty Quicker Picker Upper paper towels in North America and Kimberly-Clark’s Scottex Complete Clean in Italy with 3D texture for strength and softness.

Durability and comfort are two other key pillars of consumers’ value perception, inspiring new cloth-resembling tissue products and marketing narratives. In China, for instance, Vinda International launched new kitchen towels dubbed “washable kitchen towels.” Another example is the rise of a new tissue format known as disposable facial cloth, or facial towel, which is designed for facial cleansing and drying and has carved out a growing category in Asian tissue market. Many large tissue players such as Unicharm in Japan have joined the segment. This format is becoming popular, as it combines the best of two worlds: the convenience and hygiene that come with disposables, and wet strength and absorbency of washables.

On the other hand, consumers’ value expectation is also enriched by changing household structures, which in turn drives new cleaning occasions. Notably, nearly 70% of global consumers consider pets as beloved members of the family, according to Euromonitor’s voice of the consumer lifestyle survey fielded in early 2023. Echoing with the trend, Portuguese Renova tapped into the high-growth pet care sector through its new multi-purpose Pet Care paper towels in 2023.

Blurring wellness

Today’s wellness connotes a broader lifestyle orientation, as much emotional and sentiment-driven, as it is health-based. This trend underlies the growing wellness positioning in the tissue industry that taps into broader wellness needs – such as mental and skin health. This is increasingly reflected in beauty-inspired ingredient choice, fragrance integration and skin-focused wellness marketing.

Nearly 30% of global consumers said they prefer scented feature in household essentials in 2023, according to Euromonitor’s lifestyle survey. Unsurprisingly, odour control and botanic-inspired fragrances are increasingly seen in tissue products, particularly toilet paper and facial tissues. For instance, Essity’s OdourBlock technology for its Zewa brand aims to neutralise toilet odour, while Asia Pulp & Paper (APP) introduced microcapsules embedded in its Paseo Aroma Relief facial tissues to provide personal hygiene routines an added clean sensation.

Another manifestation of blurring wellness is the merging of beauty and hygiene. Notably in facial tissues, beauty-inspired ingredients such as hyaluronic acid – a skin moisturiser that is typically seen in beauty and skin care products – are increasingly used in facial tissues as a premiumisation strategy to address common skin concerns such as dryness and irritation.

This is a trend most notable in Asia where beauty perceptions, a humid climate, and allergy seasons make sensitive skin care a crucial pain point.

Digital rewire

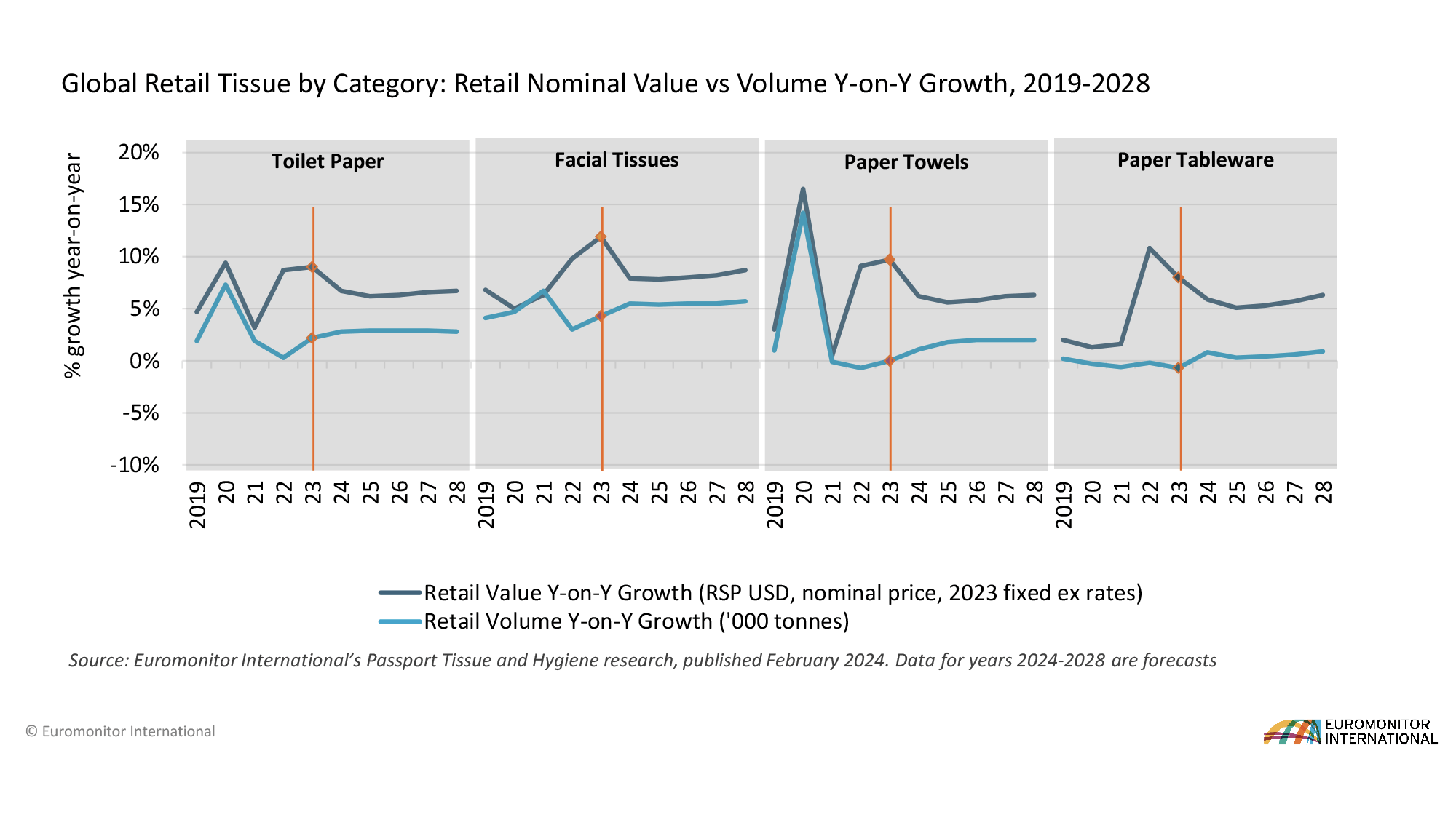

Between 2019 and 2023, e-commerce has driven more than a third of global retail tissue’s incremental value sales increase, with its share of global total reaching 16% in 2023, up from 9% in 2019.

Though the channel’s growth has much slowed from peak of pandemic, it has continued to outgrow offline channel, though from a much smaller base. As such, digital share of shelf will have an increasingly increased impact on tissue businesses’ revenues and brand loyalty.

In the US, key mass retailers’ digital investments play a key role in shaping tissue’s e-commerce momentum. For instance, over the past few years, Walmart has leveraged its vast brick-and-mortar network to drive e-commerce capabilities, from curbside pickup in 2019 to same-day delivery launched in 2022. Starting 2023, subscription service and express delivery. To stay competitive, brands need to stay digitally compatible through inventory management, packaging design and pricing.

In comparison, in the Asia Pacific region, tissue e-commerce’s development is uniquely driven by social marketplaces such as TikTok, which pivoted in 2020 from being a pure social media platform to being a retailer. Since then, it has emerged as a livestreaming giant in its home market of China and Southeast Asia.

Notably, TikTok in China (known locally as Douyin) accounted for 24% of total Chinese retail tissue online sales in 2023, up from 14% in 2022. The whopping 10%-pt increase marks the channel’s importance.

An interrelated trend is the rise of livestreaming, which has made meaningful inroads because of its ability to create an emotional connection, tangibly demonstrate product features live and selling high volume of products on promotion. Local brands such as Hearttex in China are especially keen on using TikTok live shopping shows and KOL (key opinion leader) marketing to drive brand exposure and sales.

Affordable sustainability

Tying sustainability and affordability is as much to the benefit of consumers as to businesses, especially in resources-intensive tissue industry.

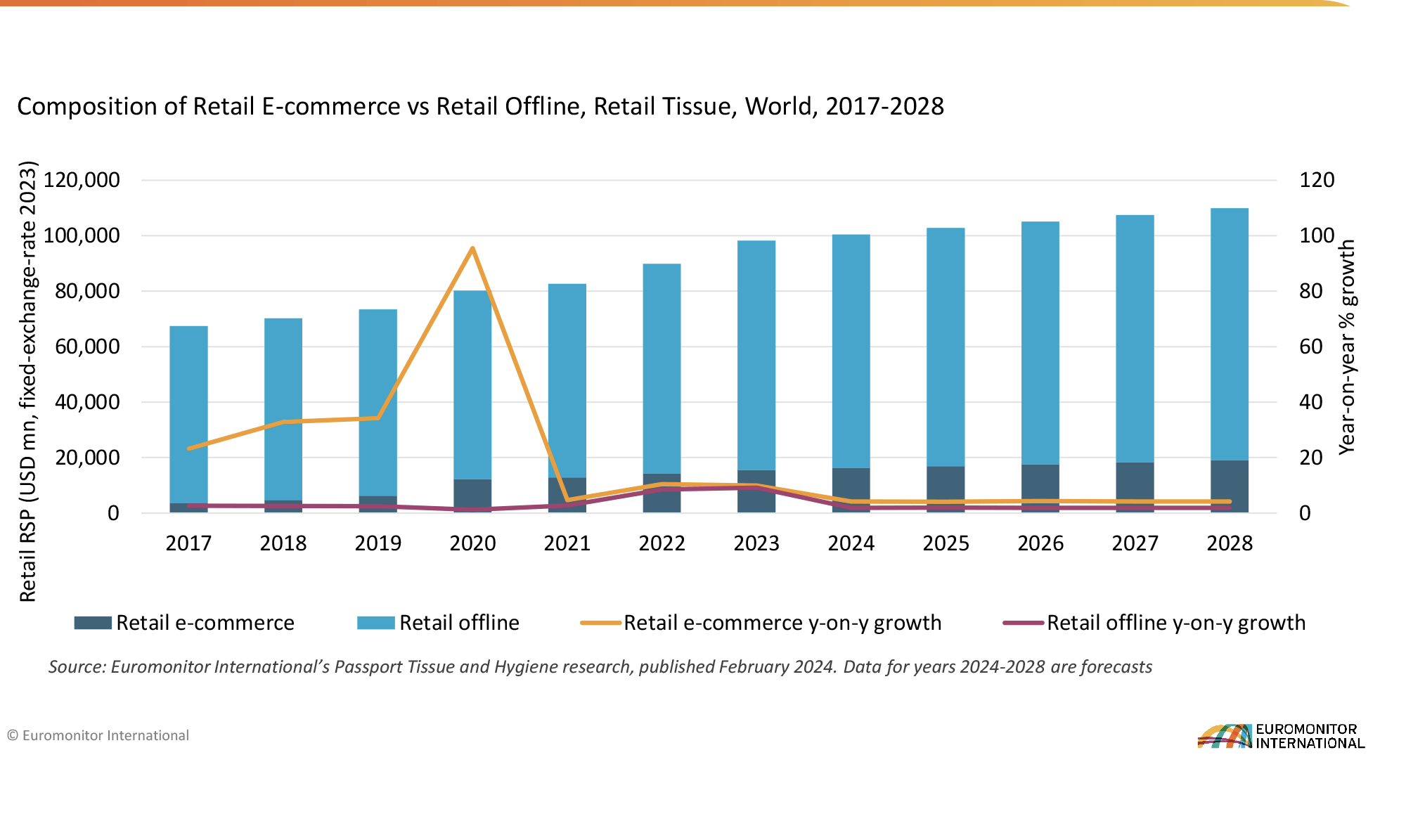

Although consumers are generally becoming more eco conscious, their aspirations and economic realities are unfortunately out of sync. According to Euromonitor’s Sustainability Survey, consumers in lower per capita income markets such as India, China, and Brazil, are more willing to pay extra for at least one sustainability attribute. Such willingness to make an economic effort is more notable in essential categories such as food and beverages and household essentials like tissue, providing an added incentive for tissue businesses to close action gap by merging affordability with sustainability.

While circular business model offers a long-term solution to reduce costs, choosing the right sustainability claims that resonate with consumers is also key.

With sustainability attributes in tissue still commonly associated with premium pricing, indicating existing economic barrier for adoption, consumer satisfaction, interestingly, does not always correspond with a cheaper price tag.

For example, locally sourced is associated with higher price premium per SKU, but consumers seem to be on average quite happy with the products, indicating the claim’s ease to comprehend and tangibility that evokes trust and willingness to pay. In contrast, plastic-free packaging has a much lower price premium per SKU on average, yet consumers don’t seem to reward it with higher satisfaction, which exposes potential consumer concerns about packaging quality and product contamination during shipping and reveals quality as a fundamental priority above all.

Conclusion

With the cost-of-living crisis solidifying importance of value and affordability, demonstrating product mileage with a focus on core benefits and problem solving is key to differentiate in a commoditised sector as tissue. Adapting products to changing household structures, need states and expanded wellness demands and aligning supply chain with new digital business models can bring new opportunities for penetration and differentiation.

More importantly, while sustainability is increasingly recognised as a long-term, cost-saving strategy, it often comes with a hefty price tag. Choosing claims that best resonate with consumers in the short-term, with tangible, traceable evidence, and uncompromised quality, while pursuing a circular business model in the long run will be key to drive consumer adoption.